Companies in the industry

GUINNESS products belong to the alcoholic beverages industry, which is typically divided into beers, wines and spirits. Therefore, when categorized further, GUINNESS falls into the beer brewing industry. The GUINNESS company is owned by Diageo, a global leader of the alcoholic beverages industry. Diageo is considered a major producer of beer and wine, but the world’s largest producer of spirits. Some other major players that focus on beer for business include AB InBev, Heineken, Molson-Coors, and Brown-Forman.

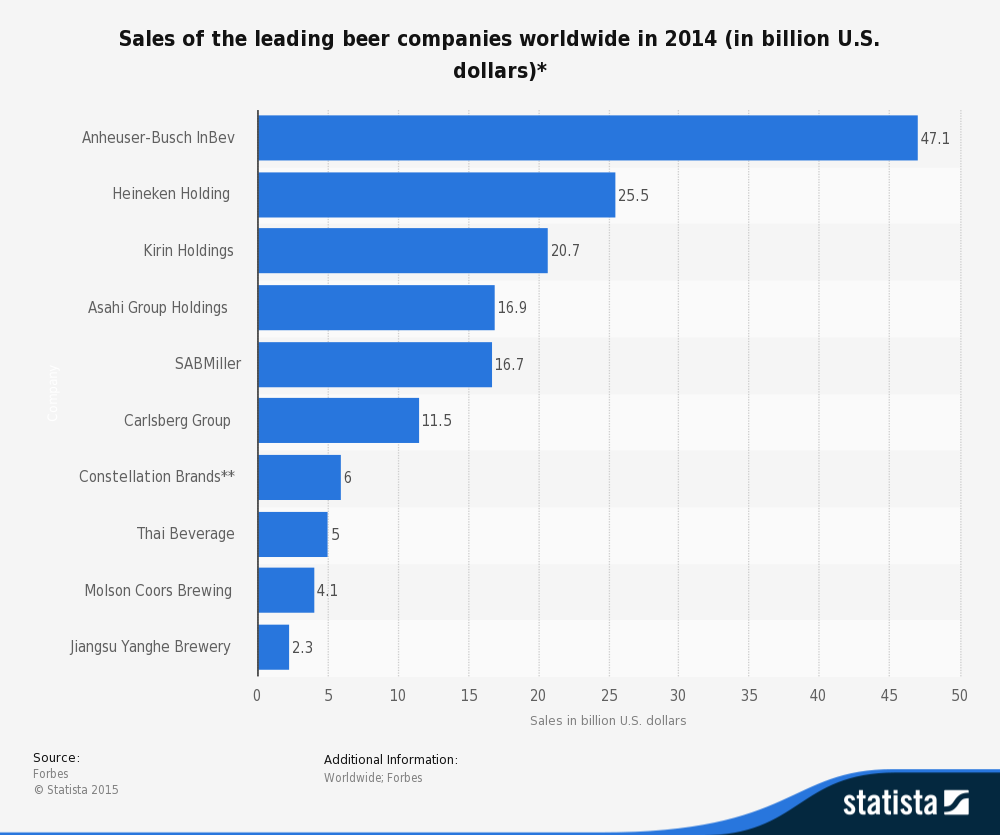

The bar chart below shows the sales of the leading beer companies worldwide in 2014 (in billion US dollars)

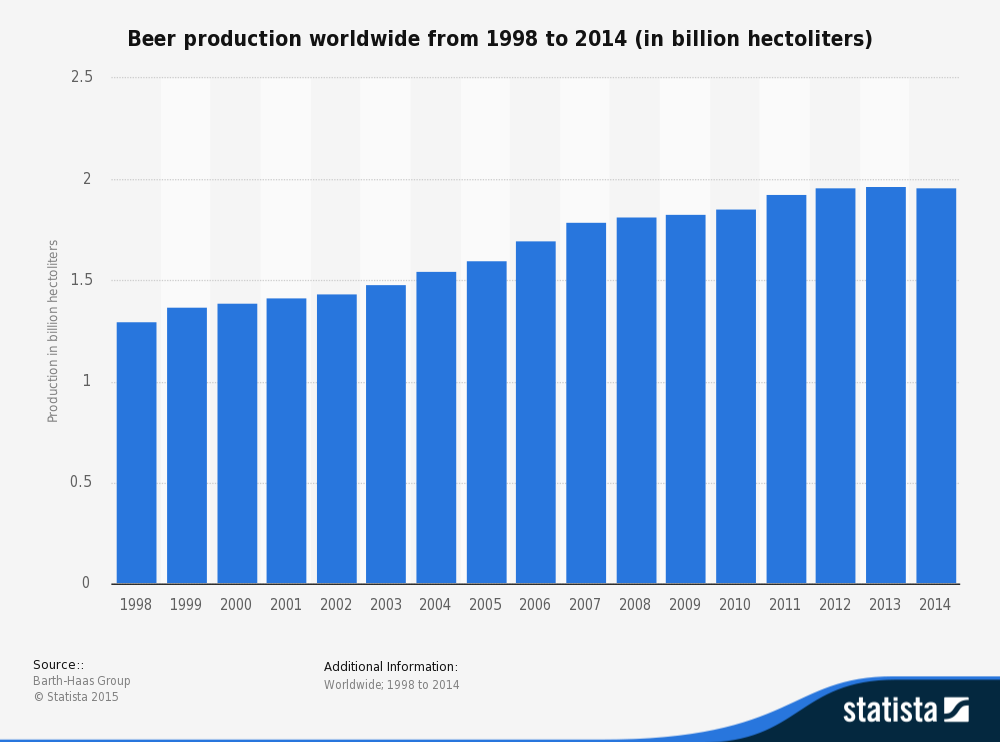

This barchart shows beer production worldwide from 1998-2014 (in billion hectoliters) 1.96bn hectolitres of beer was produced in 2014.

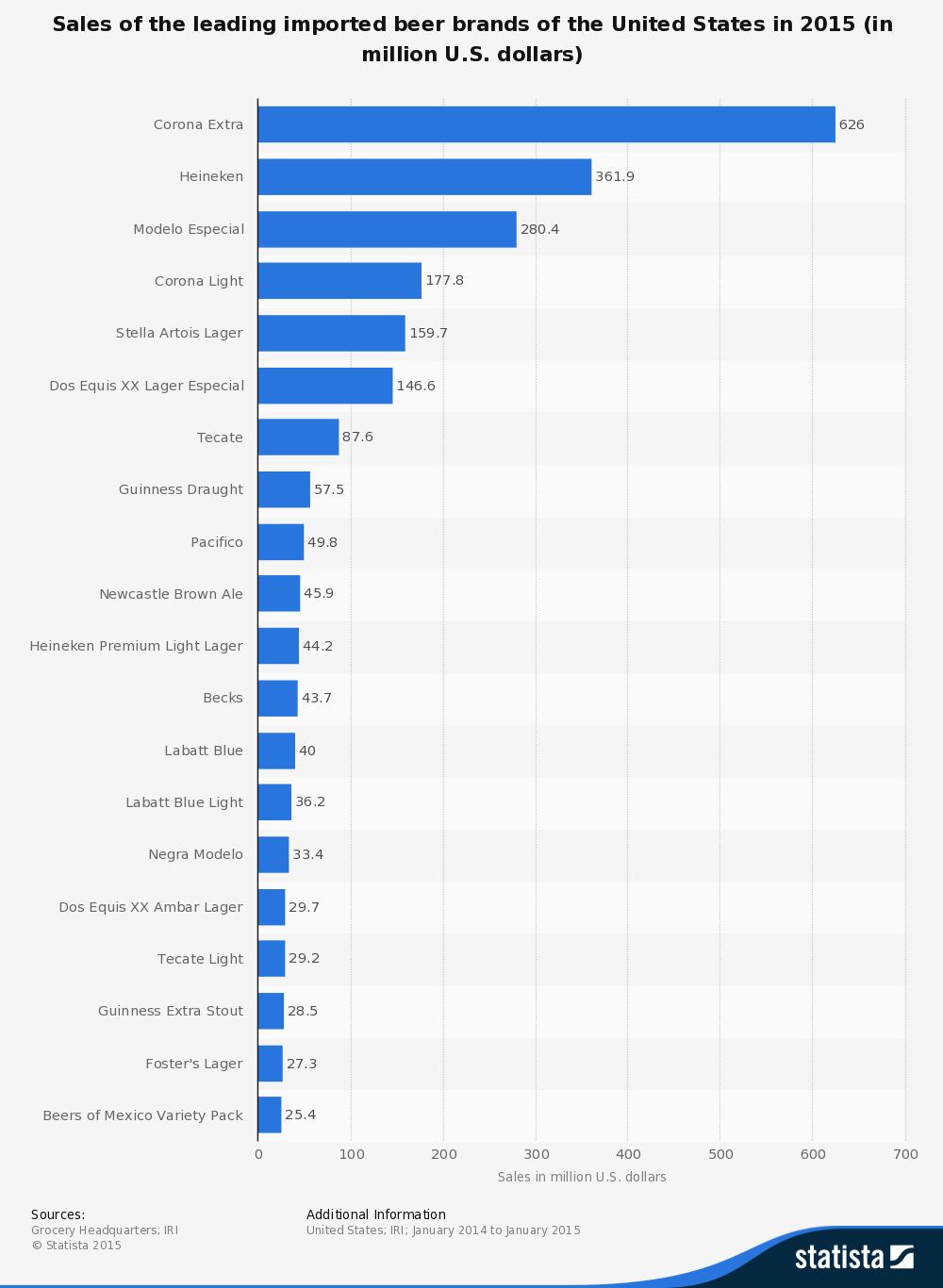

If we look at beers imported to the U.S. in 2015 (in million U.S. dollars) we see that GUINNESS® falls 18th in the list of the leading beer imports.

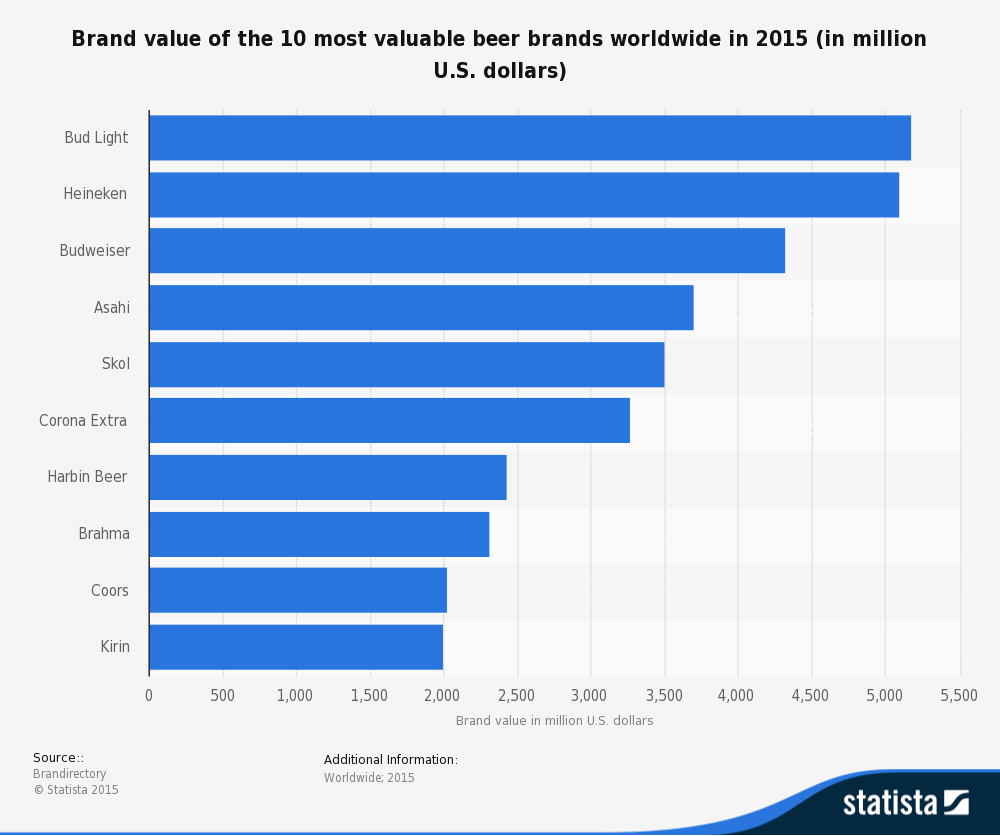

The following chart shows the 10 most valuable beer brands worldwide in 2015 (in million U.S. dollars)

Beer has a stronghold on the alcoholic beverages industry, as it is the most popular alcoholic drink worldwide. It even ranks high for beverages outside its own industry by being the third most popular drink overall, after water and tea. Beer has deep historical roots, possibly first prepared in the early Neolithic period (9500 BC) and is possibly the world’s oldest fermented beverage.

Growth Patterns

Research shows that the demand curve for beer is a traditional negative slope, meaning as income increases, demand increases. Beer is therefore considered a “normal” good.

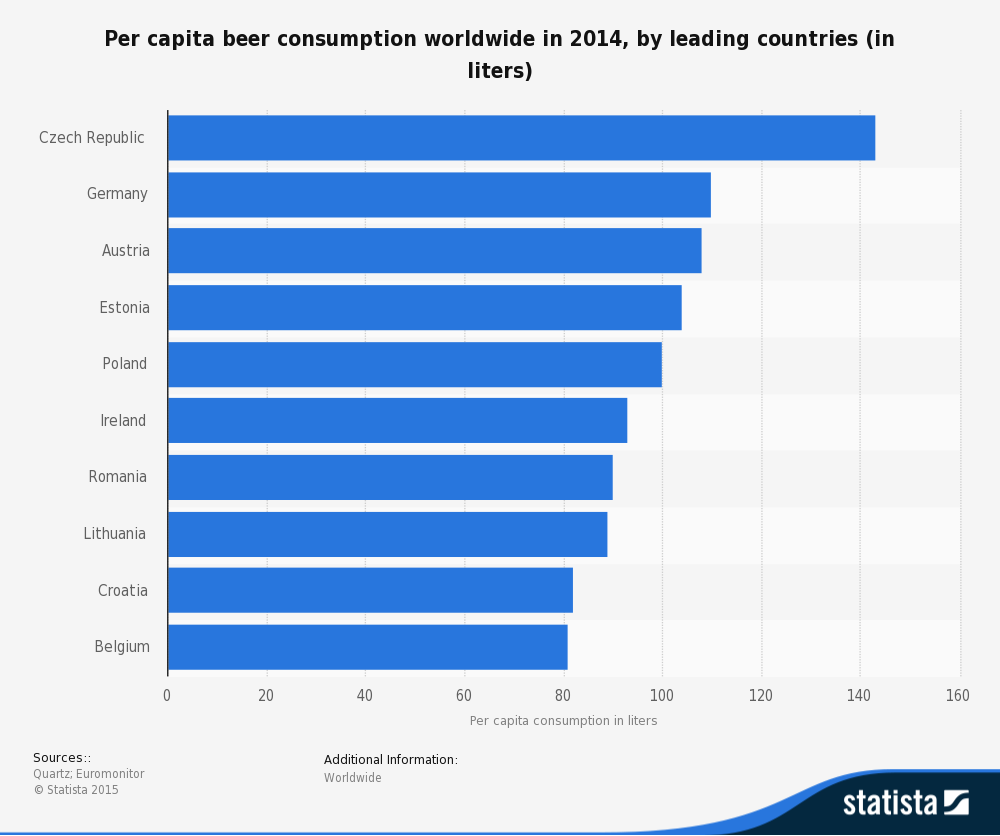

This barchart shows the per capita beer consumption worldwide in 2014, by leading countries (in liters).

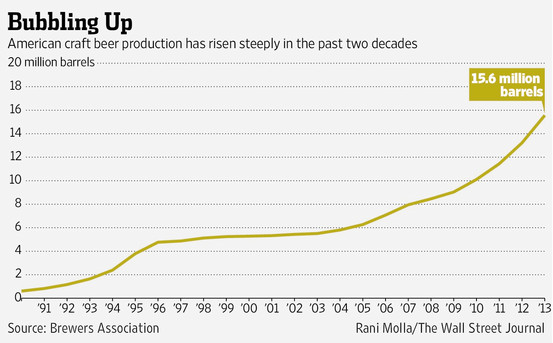

The potential for growth in this industry can be found in emerging business trends. These include things like premiumization of beer and production of craft beers at microbreweries. According to industry professionals, there is also room for growth in production of ‘healthy’ and organic beer varieties.

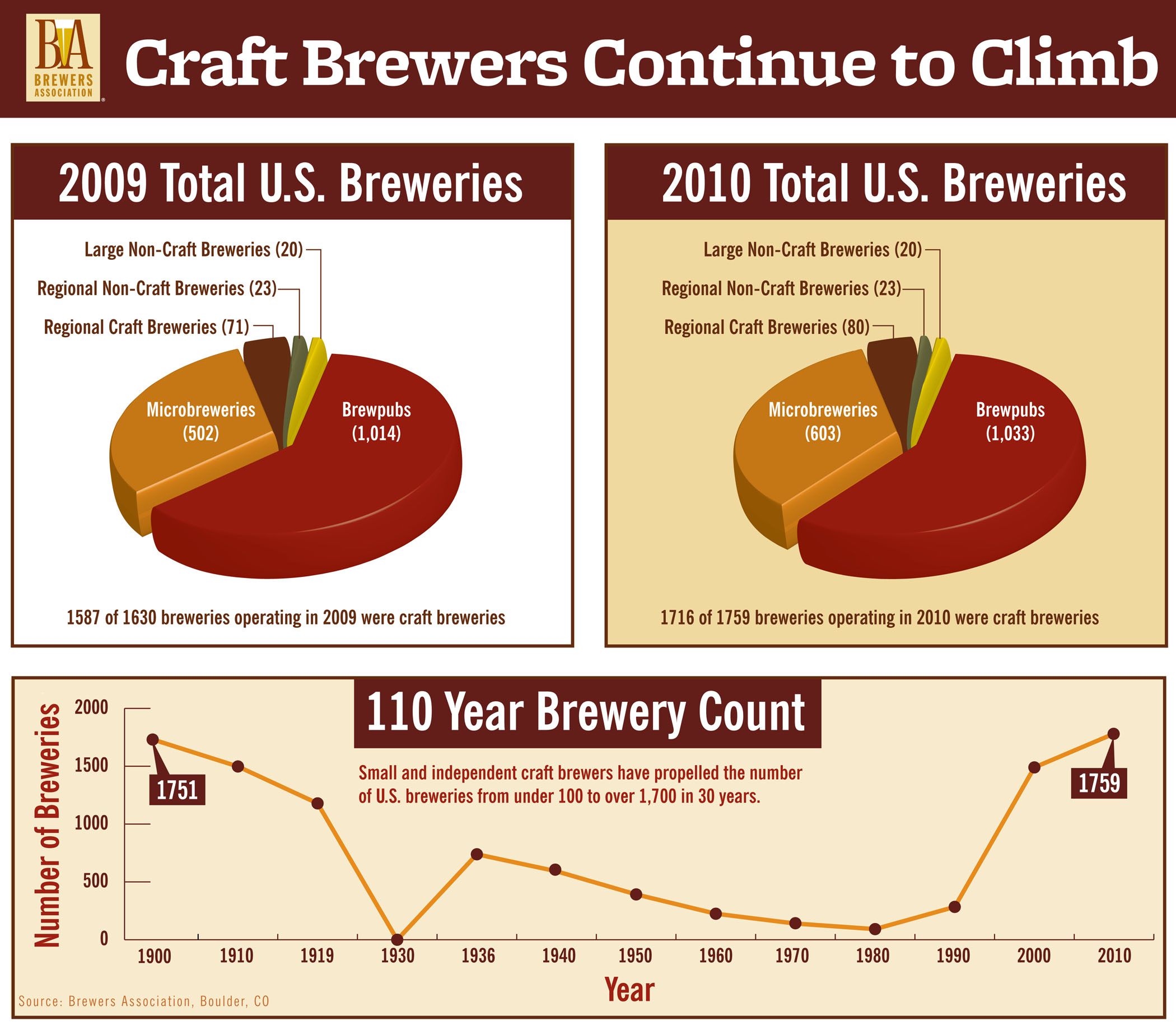

These graphics illustrate the recent steep increase in US craft beer breweries:

History of the Industry

Beer has existed for thousands of years. micro and family breweries dominated the industry during most of its existence, but in the past couple decades, starting with the Industrial Revolution, it became a globalised industry. For a detailed description of the history of beer, click the thumbnail to enlarge the infographic by Manolith.com

Beer has existed for thousands of years. micro and family breweries dominated the industry during most of its existence, but in the past couple decades, starting with the Industrial Revolution, it became a globalised industry. For a detailed description of the history of beer, click the thumbnail to enlarge the infographic by Manolith.com

– http://visual.ly/history-lesson-story-beer

Fifteen years ago, the industry was mostly fragmented, but industry today is characterised by a smaller collection of enormous beer enterprises – the result of multiple mergers and acquisitions. Some of these consolidations are listed below. These trends have increased foreign ownership, but with the newest mega-merger on the cards, the US may become the main player.

- 1997 – Guinness PLC & Grand Metropolitan PLC merge to form English conglomerate Diageo PLC (headquarters of Guinness move from Dublin to London)

- 2002 – South African Breweries (SAB plc) acquires Miller Brewing (US second largerst brewer) to form SABMiller plc (worlds second largest brewer measured by revenues)

- 2005 – Molson Canada merged with Coors Brewing Company to form Molson Coors

- 2008 – Anheuser-Busch and InBev merge to form Anheuser-Busch InBev (60 billion U.S. dollars) (worlds largest brewer measured by revenues)

- 2008 – SABMiller plc and Molson Coors launched MillerCoors, a joint venture of their operations within the U.S. to better compete against Anheuser-Busch InBev

- 2012 – Heineken acquisition of Asia Pacific Breweries to become Heineken Asia Pacific (24 billion U.S. dollars)

- Oct 2015 – newest MEGAMERGER – Anheuser-Busch InBev to acquire SABMiller (104 billion U.S. dollars)

By merging, these companies benefit from cost-cutting opportunities and gain emerging market assets. It also allows them to stay competitive in an industry of enormous multinational beer enterprises.

As companies grow into multinational corporations, negative social and environmental costs to communities and countries of producers and suppliers has been a trend. A counteraction to this is the implementation of corporate social responsibility initiatives across the industry. The largest ever industry initiative is the Global Beer, Wine and Spirits Producers’ commitments found here: http://www.producerscommitments.org/

This was developed following a United Nations (UN) political declaration on the prevention and control of non-communicable diseases, the World Health Organisation (WHO) has set a target of reducing alcohol-related harm by 10% across the world by 2025.

These companies continue to mass-produce beers, but the supply is starting to evolve with evolving demands in the market. Traditional breweries that benefit from buying materials in bulk and accessing efficient transportation can produce in large volumes at lower prices making the beer less expensive to buy. However, we are seeing an emergence of “craft breweries” that use more traditional methods and ingredients in the brewing process as well as microbreweries that produce in low volumes.

There have also been plenty of technological advances in the industry. Brewery operation advancements in construction materials and systems (heating/cooling) have led to increases in productivity. Bottling and packaging have made advancements too. Beer once bottled in stoneware moved to glass bottles and aluminium cans and even bottle-shaped aluminium cans. Small kegs can be purchased for a home refrigerator. Some beer cans show the consumer when their beer is cold. Widgets were invented so draught beers could be brought home in cans, and the Hoppier device was invented which allows consumers to personalize the flavour of their beer.

Characteristics of industry

There are many types of beer produced in the industry and they can be segmented into different price points (expensive beers vs inexpensive varieties). The industry will shift with shifts in economic conditions and how the governments regulate alcohol sales, but for the most part, the industry has proven to be “recession-proof”. An example of this is the rise in stock of major beer-producing companies during the dotcom bust in the 90s. People do not stop drinking beer, but they tend to switch to cheaper or store-name brands. Wine and spirit drinkers will also turn their attention to less expensive beer in these times, boosting sales.

After the prohibition a three-tier system for distribution came about. All alcohol was now required to pass through a middleman in order to prevent producers from owning the production and retail of the industry and potentially limiting consumer choice.

The three-tier system

- top tier – the brewer who produces the beer

- second tier – distribution

- third tier – retail (grocery store, bar or state-regulated vendor) – exception: brewpubs – restaurants or pubs that produce beer on site for sale on site

The global beer market is segmented into Asia Pacific, North America, Europe, and Rest of the World.

The industry is one of the most highly regulated industries in the world. Product packaging and labeling regulations exist and differ from country to country. Tastes can also be country-specific meaning recipes sometimes must adapt to suit those tastes. High taxes and duties and strict government rules and regulations in certain regions can also create barriers for the industry. For instance in the U.S. beer is considered a ‘vice’ and must be closely monitored by local, state and federal governments. Municipalities regulate the sale of alcohol by imposing limiting factors like taxation and state-sponsored stores to raise funds and control the amount of alcohol being sold and consumed. Lowering the supply of beer can increase prices and deter overdrinking. Other factors that can create restraints on the global beer market include: seasonality and climatic conditions (for production of ingredients and distribution), demographics and social norms (drinking is not allowed in Islamic states), health regulations, increasing fuel prices (needed for production and global distribution), fluctuating rate of employee retention, unstable consumer spending, legal drinking age, and advertising restrictions on products that are considered bad for health.